A piece of land holds value and it cannot be determined as to who owns the right to the land simply by looking at it. Proper documentation is required to have a clear property ownership title and property transfer. Whatever may your reason be, property transfer requires adequate paperwork following all legal procedures as per the transfer of property Act, 1882. In case of failure to show records and required documents, property transfer can be undermined or nullified. So, it is necessary to register all property ownership records at the Sub-registrar office and if a property is transferred to another person, they are liable to apply for property name transfer to reflect the transfer.

Property Registration in Telangana: Process & documents

Property owners/ buyers have to register with the Telangana Registration and Stamp department to legalize the right to ownership. The Telangana Government has started an online portal to facilitate property registration where all the documents can be uploaded online.

Registration Process

The Registration process with Telangana Registration and Stamp department is as follows:

- The applicant must visit the Telangana Registration and Stamp Department portal and upload all the documents regarding the transaction using public data entry.

- The portal allows the applicant to make the requisite fee payment online and the option to choose an appointment slot at the Registrar’s office to reduce the time taken to complete the registration.

- Once all the documents are submitted online, the applicant can head to the Registrar Office to complete the process.

- Based on the uploaded documents, a check slip is generated by the officer at the SR office and the necessary changes are made based on the details mentioned in the public data entry.

- After the details are updated, the applicant must complete the E-KYC compliances and the applicant’s fingerprint sample is registered/ verified using Aadhaar/ e-Aadhaar.

- Now any pending payment must be completed, so the endorsements are printed and registered by the Registrar via a Document number.

- The document is then scanned and uploaded onto the portal, where the applicant can download it whenever required.

Documents required for registration

In case the required documents are not approved, the applicant must re-submit the application with the suggested changes and complete the set of the required document. The applicant must submit these documents during registration of sale agreement:

- Certificate of encumbrance

- Original property documents bearing the signature of all parties

- Challan/DD as evidence of full payment (stamp duty, transfer charges, etc)

- Property Card

- Identity Proof of the buyer, seller and the witness

- PAN card

- Power of attorney, if applicable

- Aadhaar card

- Section 32A Photo form of executants/claimants/witnesses

- Two witnesses with photo ID proofs

- Address proof of the parties involved: Aadhaar card or Passport issued by the Government of India or Driver’s License issued by the transport department or PAN Card issued by the IT department or Ration Card issued by Civil Supplies Department or Voter ID by Election Commission of India can be used as address proof.

- Photograph of the front view of the property (8/6 inches)

- GPA /SPA if applicable (original and photocopy)

- Webland copy for agricultural property

- Pattadar passbooks/ title deeds for agricultural properties.

What are the fees and the timeline for Telangana land and property registration?

Fees

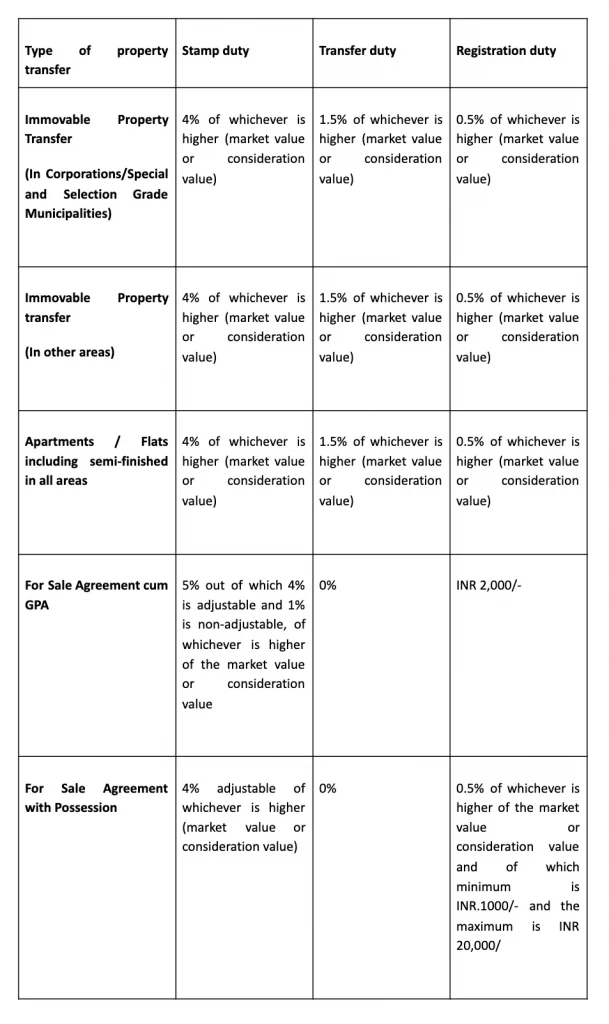

Registration fees and stamp duty are different in all states of India as prescribed rates of the registration fee are determined under Section 78 of the Indian Registration Act, 1908 (XVI of 1908) are listed in the Telangana Registration and Stamp department. The stamp duty is established on the agreement value/ market value of the property so it varies for different properties and locations. Various factors determine the stamp duty charges:

- Newer properties are expensive, hence more stamp duty as compared to older properties.

- In some cases, older individuals pay lower stamp duty due to senior citizens’ subsidies.

- In most states, women pay a lower stamp duty fee due to a 2% gender subsidy.

- Commercial properties have higher stamp duty as compared to residential properties.

- Urban localities charge higher stamp duty.

- Properties with lesser amenities pay lesser stamp duty.

Additional charges incurred are EC fees, Document preparation charges.

How to calculate the stamp duty charges and registration fee for property transfer in Telangana?

Property buyers can easily calculate stamp duty and registration charges as per the transfer of property Act, 1882:

- Click on Telangana Registration and Stamp Department online portal

- Click on the drop-down menu to choose the nature of the transaction and enter the consideration value.

- Write the name of the applicant and mention the measurements and boundary length if the property has been identified.

- Click ‘Calculate’ to see the values.

Time

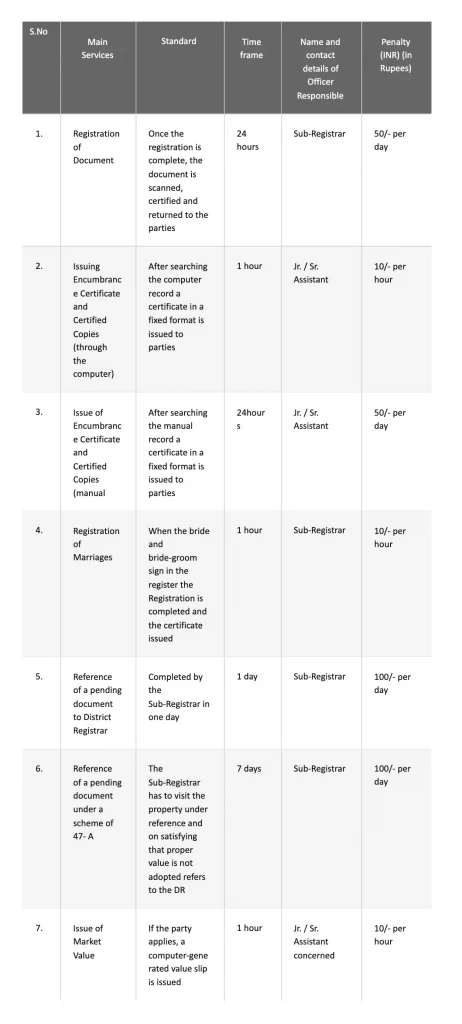

Documents for registration must be presented within four months from the date of execution (signature). In case a document is executed out of India, the four months will be counted from the date of its first receipt in India. If the applicant fails to present the documents, within the first 4 months, the documents must be presented within another four months with a penalty subject to a maximum of ten times the registration fees with the District Registrar permission. The documents must be presented within eight months before the Sub Registrar or they will not be accepted for registration.

Necessary steps for property transfer procedure in Telangana

- New ownership terms

An authorization decision between the property owner and recipients, the owner may want to hold property as joint holders with the right to survivorship. This enables the property to pass to the remaining homeowners while not fashionable probate.

- Legal attorney to prepare a deed

The deed is a legal document, it must be correct. It is advised to hire a lawyer to guide you for property transfer.

- Analyze the deed carefully

Read the deed carefully and ensure the details are correct and complete for property transfer. You must also be sure that the vendor/ vendee has entered their full legal names and details.

- Legalize the deed in front of a witness

The deed should be signed by the seller at a professional register office for property transfer and the other witnesses needed by particular state’s law. After this, it must be notarized with a signature and seal.

- Register the deed

Once the property transfer procedure is complete, legalize the property transfer by registering it at Telangana Registration and Stamp Department.

Essential things to consider while Transfer of Property

- Verify the title deed

The vendor(s) may have acquired the property title either by purchase, by inheritance, by partition, by gift, by settlement or by the grant. There must be a legal document/ record of the same. Entries in revenue records and predecessor’s title in case of inheritance, deed of partition or a gift deed are necessary to verify the title deed.

- Antecedents of the vendor(s)

You must verify the character and the antecedents of the vendor(s) before buying a property. If the vendor(s) is a habitual legal offender or was involved in real estate offenses/ other crimes, you may not want to sign a deed with them.

- The name change in the property tax document

You need to submit the documents to the Commissioner of Revenue to change the name of the property owner. The required documents include the last paid tax receipt, attested copy of sale transaction deed, NOC from the particular housing society, rightfully filled application form with signatures. The process may take up to 25 to 35 days.

- Memorandum of understanding (MoU)

You need to sign a deed to buy a property in Hyderabad. Before signing a deed, both the purchaser and seller are required to sign MoU. An MoU holds all the information on the cost of the property, the date of the agreement between a buyer and a seller, the agreed duration of the whole amount to be paid, details of the property, etc.

- Quitclaim deed

Quitclaim deed is to clear up the title issues in property transfer during critical issues like separations of couples or any spontaneous decisions for property name transfer. This deed includes the complete information of the vendor/ vendee and the property, i.e., price of the property, location, and legal description specifying the particulars of the property.

- Warranty deed

The warranty deed gives the assurance to the buyer that the seller has all legal rights to transfer the property, and nobody else possesses the rights to do so and the property is not under any debt.

- Property mutation

To be recognized as the owner of a property by the government, you need to submit an application with a non-judicial stamp to the respective Tehsildar with property name transfer. One of the most crucial documents is the NOC to initiate the purchase and a testimony. Property mutation is used to transfer the ownership from the seller to the receiver after the completion of the buying process.

Services provided by the Telangana Registration Department

- Property Registration

- Registration of Marriages

- Chit Fund Registration

- Partnership Deed Registration

- Societies Registration

- Stamp Vending

Property transfer is no easy task to accomplish. You need to make sure you do your research before buying/ selling a property. Examine and find out the title of the seller and the nature of his right. Only if a seller has a proper and valid title, on a purchase you will get a valid title after a property transfer. The legalities and deeds can be confusing for anyone. It is better to transfer property under the guidance of an attorney to ensure safe and secure transfers and save yourself from any kind of scam.